Supermarkets Inquiry: Next Phase Commences as ACCC takes Woolworths and Coles to court over alleged misleading ‘Prices Dropped’ and ‘Down Down’ claims

.jpg?timestamp=1677315851923)

Many Australian consumers and grocery suppliers have told the ACCC they are concerned that some of Australia’s supermarket retailers have considerable market power and are engaging in practices which disadvantage both their customers and suppliers.

The Interim Report for the ACCC’s Supermarkets Inquiry, published September 27, outlines what the ACCC has heard at the halfway point of the year-long Inquiry. This includes detailed information gathered through stakeholder submissions, responses to the ACCC’s consumer survey and feedback provided by suppliers at roundtable discussions held around rural and regional Australia.

Supermarket retailing in Australia is an oligopoly, with Woolworths and Coles accounting for 67 per cent of supermarket retail sales nationally. Aldi accounts for 9 per cent and Metcash supplied independent supermarkets 7 per cent.

“Oligopolistic market structures can limit incentives to compete vigorously on price. We see Woolworths and Coles providing a broadly similar experience to customers through largely undifferentiated product ranges, pricing at similar levels and similar non-price offerings including loyalty programs,” ACCC Deputy Chair Mick Keogh said.

“So far during this inquiry we have heard in detail about many aspects of Australia’s grocery markets. Increasing grocery prices are one key contributor to the rising cost of living and are front of mind for consumers, given how often people shop at supermarkets and how much of their incomes people spend there.”

The price of a typical basket of groceries has increased by more than 20 per cent in the past five years.

The ACCC’s consumer survey indicated that the majority of respondents in low-income households are spending more than 20 per cent of their net income on groceries.

“We have observed that food price growth in the last five years is largely in-line with inflation in other goods and services, and that food price inflation is lower in Australia than in most OECD countries. However, we will look very closely at the extent to which any market power held by the supermarkets has a role in increasing prices to consumers or decreasing prices to suppliers.”

“During the remaining five months of our Inquiry we will scrutinise whether, and if so how, the supermarkets may be using market power and the economic implications this has for Australian consumers and suppliers.”

“We will examine whether supermarkets are exercising market power to increase retail prices more than is necessary to accommodate increases in the wholesale prices supermarkets pay.”

“We are also examining whether supermarkets are engaging in other business practices that may cause detriment to consumers or suppliers,” Mr Keogh said.

ACCC Deputy Chair Mick Keogh. Photo: ACCC

Many consumers report having lost trust in supermarket pricing

Many consumers are concerned about higher prices at the supermarket and are increasingly comparing grocery prices online before going shopping. However, they face real difficulties in trying to compare prices and find the best value for products, consumers told the ACCC.

“Many consumers have told us that they are losing trust in the sale price claims by supermarkets,” Mr Keogh said.

“These difficulties reportedly arise from some of the pricing practices of some supermarkets, such as frequent specials, short-term lowered prices, bulk-buy promotions, member-only prices and bundled prices.”

Almost 50 per cent of respondents to the ACCC’s recent consumer survey said that they ‘always’ or ‘most times’ compare prices between stores before shopping. In contrast, the ACCC’s 2008 Grocery Inquiry found that only 17 per cent of consumers reported ‘always’ comparing prices.

Many consumers have also raised concerns that they are being penalised for not participating in supermarket loyalty programs, particularly following the emergence of member-only pricing.

“With the introduction of member-only pricing, some consumers may feel they have no option but to participate in loyalty programs, even if they have concerns about handing over data to the supermarkets,” Mr Keogh said.

Suppliers report facing unfavourable terms that are set by supermarkets

Many grocery suppliers have told the ACCC that they consider they sometimes receive prices below the cost of production and have little choice but to agree to highly unfavourable terms, with these terms being subject to ongoing changes by the major retailers.

“The issues raised by a number of suppliers are concerning. We are using our compulsory information gathering powers to examine this reported behaviour by the supermarkets, and will include any findings in our Final Report,” Mr Keogh said.

Some of the issues raised by suppliers include being required to pay rebates to retailers for specials and promotions, to use retailer-specified advertising and transport services, and to comply with burdensome accreditation and packaging requirements.

In particular, perishable product suppliers have raised strong concerns about supermarket procurement practices, including accreditation obligations, demand forecasting, the application of quality standards and weekly tendering processes that lack transparency and transfer considerable risk on to suppliers.

“We are considering these issues and are analysing whether supermarkets are contributing to, or taking advantage of, information asymmetries, leading to suppliers not having access to the information they need to make efficient business decisions,” Mr Keogh said.

Barriers to expansion

The ACCC observes that ALDI has taken more than 20 years to reach a 9 per cent share of national supermarket retail sales. This demonstrates the level of difficulty entering and expanding in supermarket retailing, and the significant investment, time and differentiated offering required to expand.

“Our preliminary view is that planning and zoning laws may slow a supermarket retailer’s ability to develop new stores by creating additional costs or adding significant delays,” Mr Keogh said.

“We have received submissions raising concerns about alleged ‘land banking’ but have not yet formed any views on this issue.”

Information provided by Coles and Woolworths suggests land may be held for lengthy periods of time for various reasons, including the need to obtain rezoning and development or planning approvals, construction delays, site cleanups, and population growth being slower than expected.

Information provided to us suggests Coles and Woolworths have interests in a significant number of sites intended for future supermarket use:

- Woolworths has interests in 110 sites

- Coles has interests in 42 sites

By way of comparison, information provided by ALDI suggests it holds 13 undeveloped sites.

We are considering this issue further for the purposes of our Final Report, the ACCC stated.

ACCC takes Woolworths and Coles to court over alleged misleading ‘Prices Dropped’ and ‘Down Down’ claims

The release of the Interim Report comes days after the ACC announced it has commenced separate proceedings in the Federal Court against Woolworths Group Limited (Woolworths) (ASX: WOW) and Coles Supermarkets Australia Pty Ltd (Coles) (a subsidiary of Coles Group Limited - ASX: COL) for allegedly breaching the Australian Consumer Law by misleading consumers through discount pricing claims on hundreds of common supermarket products.

The ACCC’s allegations relate to products sold by each of Woolworths and Coles at regular long-term prices which remained the same, excluding short-term specials, for at least six months and in many cases for at least a year.

The products were then subject to price rises of at least 15 per cent for brief periods, before being placed in Woolworths’ ‘Prices Dropped’ promotion and Coles’ ‘Down Down’ promotion, at prices lower than during the price spike but higher than, or the same as, the regular price that applied before the price spike.

“Following many years of marketing campaigns by Woolworths and Coles, Australian consumers have come to understand that the ‘Prices Dropped’ and ‘Down Down’ promotions relate to a sustained reduction in the regular prices of supermarket products. However, in the case of these products, we allege the new ‘Prices Dropped’ and ‘Down Down’ promotional prices were actually higher than, or the same as, the previous regular price,” ACCC Chair Gina Cass-Gottlieb said.

“We allege that each of Woolworths and Coles breached the Australian Consumer Law by making misleading claims about discounts, when the discounts were, in fact, illusory.”

“We also allege that in many cases both Woolworths and Coles had already planned to later place the products on a ‘Prices Dropped’ or ‘Down Down’ promotion before the price spike, and implemented the temporary price spike for the purpose of establishing a higher ‘was’ price,” Ms Cass-Gottlieb said.

ACCC Chair Gina Cass-Gottlieb. Photo: ACCC

The ACCC alleges the conduct involved 266 products for Woolworths at different times across 20 months, and 245 products for Coles at different times across 15 months. The representations were made on pricing tickets displayed to consumers in-store on supermarket shelves and online, usually with a ‘was’ price displayed showing what the price was during the short-term price spike and the date of that price.

The ACCC identified this conduct through consumer contacts to the ACCC and social media monitoring, and then conducted an in-depth investigation using its compulsory powers.

“Many consumers rely on discounts to help their grocery budgets stretch further, particularly during this time of cost of living pressures. It is critical that Australian consumers are able to rely on the accuracy of pricing and discount claims,” Ms Cass-Gottlieb said.

“We allege these misleading claims about illusory discounts diminished the ability of consumers to make informed choices about what products to buy, and where.”

The ACCC estimates that Woolworths and Coles sold tens of millions of the affected products and derived significant revenue from those sales.

The ACCC is seeking declarations, penalties, costs and other orders. The ACCC is also seeking community service orders that Woolworths and Coles must each fund a registered charity to deliver meals to Australians in need, in addition to their pre-existing charitable meal delivery programs.

Alleged conduct

The ACCC alleges that the supermarkets offered certain products at a regular price for at least 180 days. They then increased the price of the product by at least 15 per cent for a relatively short period of time, and subsequently placed it onto their ‘Prices Dropped’ or ‘Down Down’ program.

The ACCC alleges the display of the Prices Dropped and Down Down tickets was misleading, as the price of the products was in fact higher than or the same as the regular price at which the supermarket had previously offered the products for sale.

Alleged conduct by Woolworths

The ACCC alleges that Woolworths made false or misleading representations to consumers about the prices of 266 products during the period between September 2021 and May 2023.

Products affected include Arnott’s Tim Tams biscuits, Dolmio sauces, Doritos salsa, Energizer batteries, Friskies cat food, Kellogg’s cereal, President butter, Listerine mouthwash, Moccona coffee capsules, Mother energy drinks, Mr Chen’s noodles, Nicorette patches, Ocean Blue smoked salmon, Oreo cookies, Palmolive dishwashing liquid, Raid insect spray, Sprite soft drink, Stayfree pads, Twisties, Uncle Tobys muesli bars, and Vicks VapoDrops.

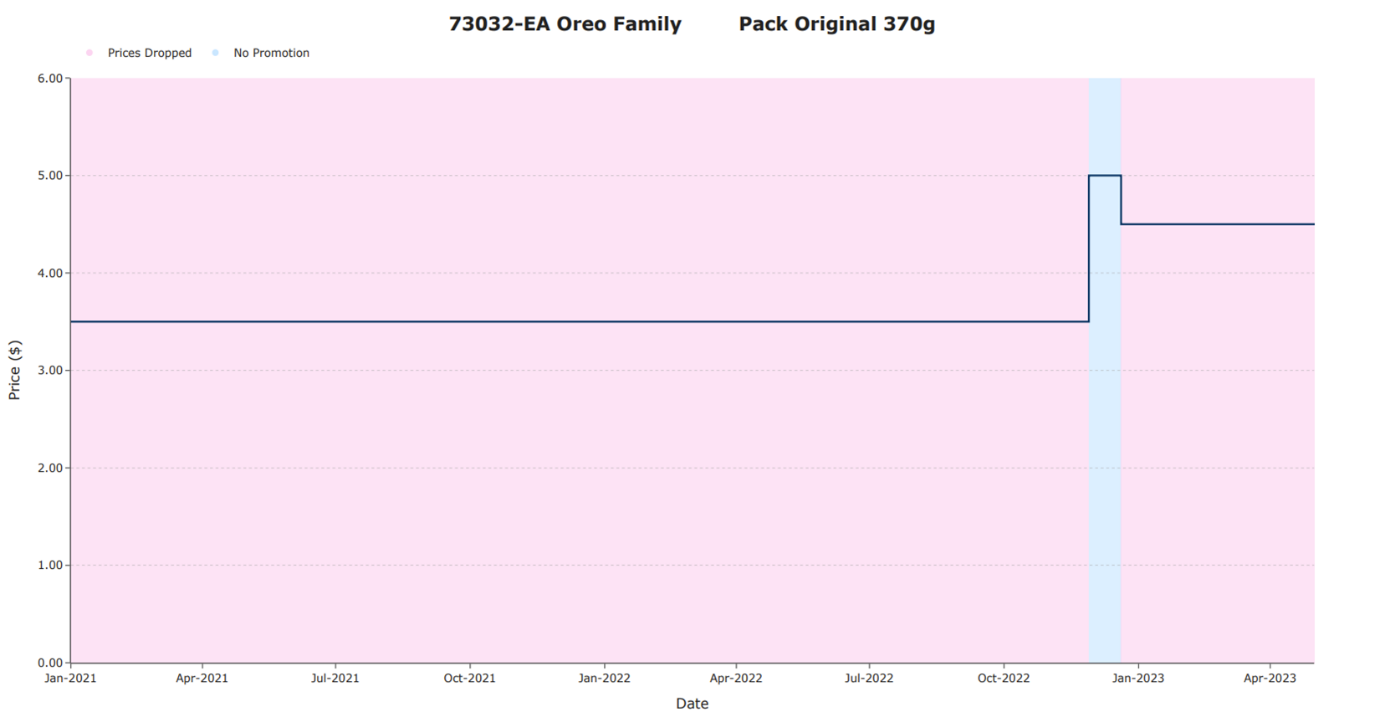

Example - Oreo Family Pack Original 370g

Chart Image: ACCC

From at least 1 January 2021 until 27 November 2022, Woolworths offered the Oreo Family Pack Original 370g product for sale at a regular price of $3.50 on a pre-existing ‘Prices Dropped’ promotion for at least 696 days.

On 28 November 2022, the price was increased to $5.00 for a period of 22 days. On 20 December 2022, the product was placed on a ‘Prices Dropped’ promotion with the tickets showing a ‘Prices Dropped’ price of $4.50 and a ‘was’ price of $5.00. The ‘Prices Dropped’ price of $4.50 was in fact 29 per cent higher than the product’s previous regular price of $3.50.

In this example, the ACCC alleges Woolworths had planned the temporary price spike to establish a new higher ‘was’ price for the subsequent ‘promotion’. Woolworths had decided (after a request from the supplier for a price increase) on or around 18 November 2022 to take the product off ‘Prices Dropped’, increase the price, and then put the product back on to ‘Prices Dropped’ three weeks later.

Alleged conduct by Coles

The ACCC alleges that Coles made false or misleading representations to consumers about the prices of 245 products during the period between February 2022 and May 2023.

Products include Arnott’s Shapes biscuits, Band-Aids, Bega cheese, Cadbury chocolates, Coca Cola soft drink, Colgate toothpaste, Danone yoghurt, Dettol multi-purpose wipes, Fab laundry liquid, Karicare formula, Kellogg’s snack bars, Kleenex tissues, Libra tampons, Lurpak butter, Maggi two-minute noodles, Nature’s Gift dog food, Nescafe instant coffee, Palmolive shampoo, Rexona deodorant, Sakata rice crackers, Sanitarium Weet-Bix cereal, Strepsils lozenges, Sunrice rice, Tena pads, Viva paper towels, Whiskas cat food, and Zafarelli pasta.

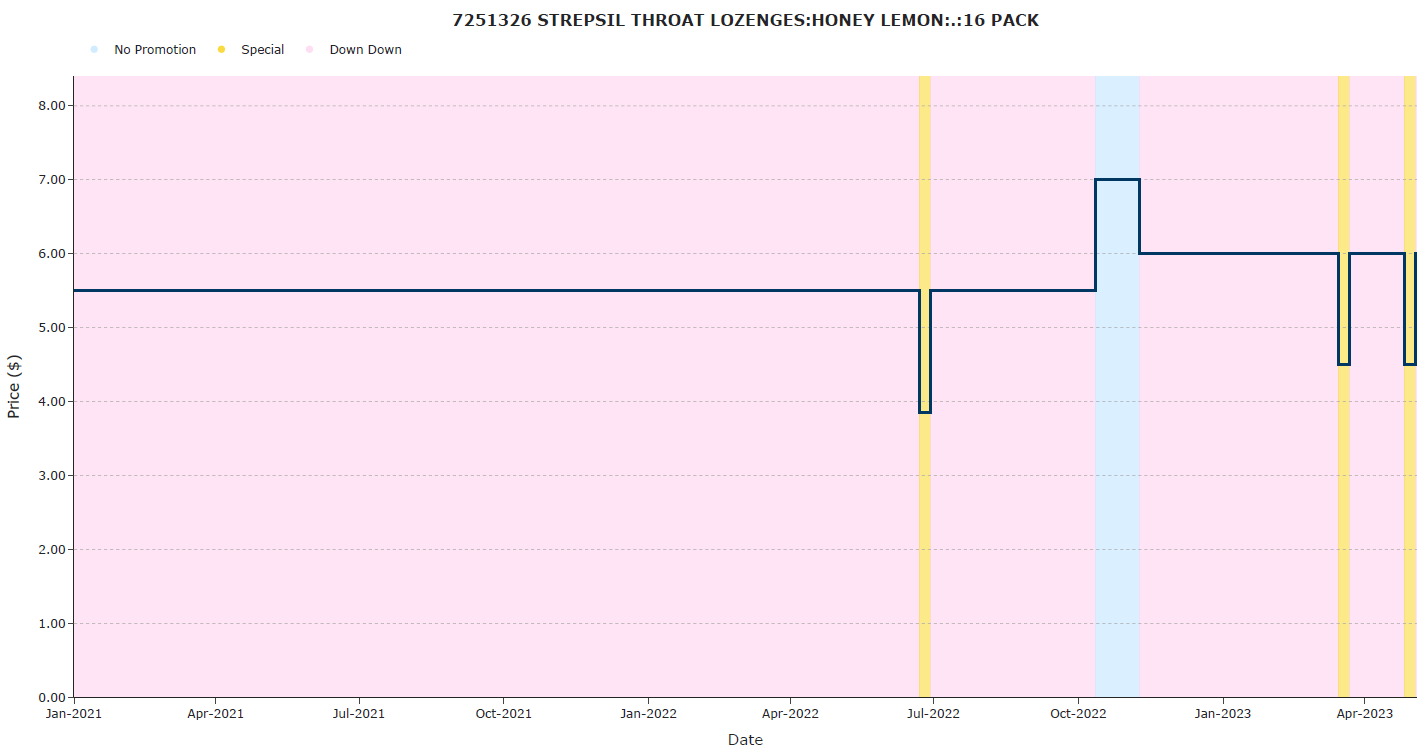

Example Strepsils Throat Lozenges Honey & Lemon 16 pack

Chart Image: ACCC

From at least 1 January 2021 until 11 October 2022, Coles offered the Strepsils Throat Lozenges Honey & Lemon 16 pack product for sale at a regular price of $5.50 (on a pre-existing ‘Down Down’ promotion) for at least 649 days, including one seven-day short-term special.

On 12 October 2022, the price was then increased to $7.00 for a period of 28 days. On 9 November 2022, the product was placed on a ‘Down Down’ promotion with the tickets showing a ‘Down Down’ price of $6.00 and a ‘was’ price of $7.00. The ‘Down Down’ price of $6.00 was in fact 9 per cent higher than the product’s previous regular price of $5.50.

In this example, the ACCC alleges Coles had planned the temporary price spike to establish a new higher ‘was’ price for the subsequent ‘promotion’. Coles had decided (after a request from the supplier for a price increase) on or around 7 October 2022 to take the product off ‘Down Down’, increase the price, and then put the product back on to ‘Down Down’ four weeks later.

NB: The ACCC does not regulate supermarket prices.

The ACCC has taken proceedings in respect of alleged breaches of the Australian Consumer Law, which provides that businesses must not make false or misleading statements about prices.

Separate proceedings are brought against Woolworths and Coles, and the ACCC is not making any allegation of any collusion or anti-competitive conduct by Woolworths and Coles as part of these proceedings.

The ACCC is not alleging any contravention of the ACL by any of Woolworths’ and Coles’ suppliers in these proceedings.

The maximum penalty for each breach of the Australian Consumer Law increased on 10 November 2022, part way through the period of the alleged conduct. For contraventions from 10 November 2022, the maximum penalty is the greater of:

- $50,000,000

- if the Court can determine the value of the 'reasonably attributable' benefit obtained, three times that value, or

- if the Court cannot determine the value of the ‘reasonably attributable’ benefit, 30 per cent of the corporation's adjusted turnover during the breach turnover period for the contravention.

Any penalty that might apply to this conduct is a matter for the Court to determine and would depend on the Court’s findings. The ACCC will not comment on what penalties the Court may impose.

Woolworths runs the largest supermarket chain in Australia, with about 1,140 Woolworths supermarket stores across the country.

The ‘Prices Dropped’ Program is promoted by Woolworths as a shelf price reduction program designed to offer Woolworths’ customers consistently low prices over a prolonged period. The objective of the Prices Dropped Program was to lower the standard shelf price of a product from its previous standard (or regular) shelf price.

Example of a Prices Dropped ticket

Coles is the second-largest supermarket chain in Australia, operating more than 840 stores nationally.

Coles introduced the ‘Down Down’ Program in June 2010 and marketed it as a promotional campaign designed to reduce the regular shelf price of commonly purchased products — thereby offering customers predictable and reliable value on the items they purchased the most and reducing the cost of their shopping basket.

Example of a Down Down ticket

Separate to these proceedings, in December 2023, following a complaint by CHOICE and an investigation by the ACCC, Coles announced refunds for thousands of customers after it raised the price on 20 products that it had promised would remain ‘locked’ for a certain period of time as part of Coles’ ‘Dropped and Locked’ promotion.

Next steps for the Supermarkets Inquiry

The ACCC is continuing to consider the various issues raised, and has not yet reached any concluded views. The ACCC will present the results of its analysis in the final report of the Inquiry, due in February 2025.

The ACCC has identified fourteen products that will be the focus of detailed analysis over the remainder of the Inquiry. The ACCC has selected supply chains with varying market dynamics to compare the issues and outcomes.

The fourteen products that will be examined are:

- Beef

- Chicken

- Pork

- Bananas

- Apples

- Strawberries

- Cucumbers

- Potatoes

- Eggs

- Milk

- Cereal

- Biscuits

- Pet food

- Dishwashing tablets

The ACCC is using its information gathering powers to obtain further information, including detailed pricing and margins data, from the retailers.

The ACCC will also conduct public hearings involving senior executives of the major retailers and other relevant stakeholders in November to gain a more complete understanding of the key issues in the retail grocery sector and its associated supply chains.

More information about the public hearings will be published on the ACCC website by 24 October: Supermarkets inquiry 2024-25

A summary of key insights from the ACCC’s consumer survey have been published to the ACCC website alongside a snapshot of feedback from submissions and roundtables with suppliers. These can be found at: Supermarkets inquiry 2024-25 interim report.

A summary of the supplier roundtable discussions held across regional Australia can be found at: Supermarkets inquiry 2024-25 supplier roundtables

The ACCC invites feedback on the key issues raised in the Interim Report by 18 October 2024. This feedback will be considered before the ACCC makes findings or recommendations in the final report. Information on how to make a submission can be found on page 24 of the Interim Report.

Background

On 25 January 2024, the Australian Government announced that it will direct the ACCC to conduct an inquiry into Australia’s supermarket sector.

The ACCC received the formal direction from the Australian Government and the terms of the reference for the inquiry on 1 February 2024.

On 29 February 2024, the ACCC published an online survey and issues paper seeking views from consumers, farmers and other interested parties.

The ACCC last conducted a comprehensive inquiry into the grocery sector in 2008.

The terms of reference require the ACCC to consider matters such as the approach of suppliers, wholesalers and retailers to setting prices, the role of small and independent retailers (including those in regional and remote areas), and the use of data analytics and other technological developments.

The final report for the inquiry is due to be provided to the Government by 28 February 2025.

The ACCC’s investigation into the conduct which is the subject of our recently announced separate proceedings against Woolworths and Coles pre-dates the commencement of this inquiry. The issues in dispute in these proceedings will not be considered by the Supermarkets Inquiry.