Andrew Norton,

Australian National UniversityEvery year on June 1, student debt in Australia is indexed to inflation. In 2023, high inflation pushed the indexation rate to 7.1%, the highest since 1990.

This year, if there is no policy change, student debt balances will be increased by 4.7%.

After sustained community pressure to change the way debts are indexed, the federal government has announced plans to help students, apprentices and trainees.

How Will Student Debts Change?

This announcement is part of the 2024 federal budget on May 14. It has two components.

First, indexation for student loans will be based on whichever is lower: the Consumer Price Index (CPI), which measures inflation, or the Wage Price Index (WPI), which measures hourly wage rates in the same job.

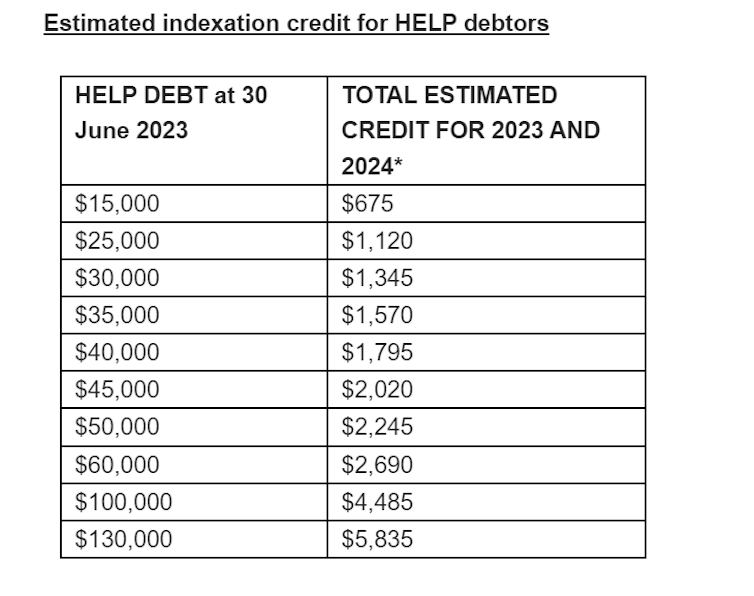

Second, in a surprise move, the government will backdate the new system to 2023. The government estimates about A$3 billion in indexation debt will be cancelled, helping about 3 million Australians.

The WPI was lower than the CPI in 2023, so the 2023 indexation rate would be cut retrospectively from 7.1% to 3.2%. Based on Australian Taxation Office data, a person with average debt levels in 2023 would see their debt cut by about $800.

The change will apply to higher education HELP loans, vocational education VET Student Loans and Australian Apprenticeship Support Loans. The Student Start-up Loan and a predecessor income support loan are also expected to be covered.

The changes will need to go through parliament.

Is This A Good Idea?

While several “lower of two indicators” indexation systems have been suggested, the idea of choosing the lower of the CPI or WPI comes from the Universities Accord final report. This was the government’s wide-ranging higher education policy review released in February.

The accord report argued a WPI cap

will ensure that the indexation of HELP debts no longer outstrips the growth in wages and the servicing capacity of debtors does not go backwards overall.

But while the government’s proposal will ease the financial pain of 2023 indexation, the WPI is not the best long-term alternative to the CPI.

It still leaves uncertainty about how high future indexation could go, including for June 1 2024.

The Fine Print

Student loan indexation uses a strange formula that includes CPI data from the two years prior to each March quarter. The government’s 3.2% figure for 2023 WPI indexation uses the same two-year indexation calculation as is currently used for the CPI.

The March quarter WPI data needed to calculate June 1 2024 indexation is not released until May 15. Until then, we do not have an exact WPI indexation rate for 2024. But if the WPI increases at a similar rate in the March 2024 quarter as it did in the second half of 2023, the WPI rate will be around 4.3%.

As 4.3% is lower than the CPI rate of 4.7%, the WPI rate would prevail under the government’s new policy.

A 4.3% WPI indexation would be more beneficial than the current system for those with student debt. But 4.3% would still be the highest indexation level since a GST-driven 5.3% in 2001 (after last year’s 7.1% is cut to 3.2%).

When Would WPI Lower Indexation?

On top of these complexities, the WPI has only been lower than the CPI four times since 2000.

All four of those cases reflected unusual circumstances. Early this century, the then new 10% GST caused inflation to increase. Overseas conflicts and post-lockdown imbalances in demand and supply have triggered the current inflationary spike.

The WPI is likely to be below the CPI early in an inflationary period. Workers respond to inflation with demands for higher wages, but effects are delayed. Salaries and wages are typically revisited on set schedules, such as the annual minimum wage case, yearly employer pay reviews and multi-year enterprise agreements. These wage-setting practices create a time lag between the CPI and WPI.

But during periods of prolonged inflation, compensating wage increases plus real wage growth cause the WPI to catch up with and overtake the CPI.

This happened (by the smallest of margins) in the December 2023 quarter of this financial year. Compared with a year earlier, the WPI was up 4.2% and the CPI 4.1%.

The Case For A Maximum Rate

As the government’s indexation policy moves through parliament, amendments could give borrowers more certainty. This includes the possibility of introducing a fixed maximum indexation rate to reduce the risk of student debt blowing out.

I have previously proposed indexation should be the lower of the CPI or 4%.

Any indexation system that uses the lower of two variable indexation rates runs the risk both will be high for significant periods of time. A maximum indexation rate does not.

People considering taking out a student loan, or estimating how long repaying their current loan will take, could be reassured indexation will never be more than 4% and will usually be less.

Welcome News But The Bigger Problem Remains

Retrospective lowering of indexation will be welcome news for the 3 million Australians with student debt.

From a government perspective, their 2023 indexation revenue will still be above the 2.5% indexation average between 2000 and 2021. So in this way, it is a good compromise between competing considerations.

But the government’s fix for 2023 leaves students vulnerable to times when the CPI and the WPI are both high.

Replacing the WPI with a fixed maximum indexation rate would mean the goverment’s student loan indexation policy solves future problems as well as past ones.

Andrew Norton, Professor in the Practice of Higher Education Policy, Australian National University

This article is republished from The Conversation under a Creative Commons license. Read the original article.

![]()