Framing the future of financial services: strengthening competition and consumer engagement

In the keynote address for the Gilbert + Tobin Financial Services Forum on Thursday 31 October 2024, ACCC Chair, Ms Gina Cass-Gottlieb spoke about the significant changes happening in the financial services sector and the implications of these for the ACCC’s work.

I’d like to begin by acknowledging the Traditional Custodians of the land we are meeting on today, the Gadigal people of the Eora nation.

I pay my respects to their Elders past and present and recognise their continuing connection to the land, sea and community. I also extend my respects to the Aboriginal and Torres Strait Islander people here with us today.

I’d also like to acknowledge the work of the Gilbert and Tobin team in organising this event and bringing together this group of industry leaders and experts. Thank you for this opportunity to discuss the significant changes happening in the financial services sector and the implications of these for the ACCC’s work.

Opportunities and challenges of an evolving financial services sector

As we all know, these changes are not happening in isolation. They’re part of a much larger shift, driven by complex, global economic and social forces. Geopolitical instability, rising cost of living pressures, rapid technological advancements and the growing urgency around climate change are reshaping how industries and economies operate.

Today, I’ll be sharing insights from the ACCC on how we see these factors impacting the financial services sector and outlining some of the key areas of our work as we navigate both the opportunities and challenges that lie ahead.

Firstly, I’ll discuss the ongoing need to protect, assist and inform consumers, and promote competition, in economically challenging times.

Secondly, I will outline how the rise of the digital economy is fundamentally transforming the way financial services operate and will continue to shape the future of our work in this space.

Finally, I will touch briefly on climate change and our work in the insurance market to understand its effect on consumers living in areas of greatest risk.

Cost of living, consumer engagement and competition in retail banking markets

First, to cost of living. With rising cost of living front of mind for many Australians, the ACCC has continued to have a strong focus on competition and consumer protection issues in essential services, including competition in financial services.

In these times of continuing high interest rates, it is more important than ever that consumers have access to a range of financial products and services and that they are able to compare offers and seek the best value for their needs and budgets.

Choice and competition in the financial services sector are key to keeping retail prices at efficient and affordable levels.

Two major pieces of work undertaken at the ACCC over the past several years — our retail deposits and home loan pricing inquiries — have highlighted ongoing challenges as well as some opportunities to improve transparency.[1], [2]

We found that consumer engagement in financial services remains low, largely due to friction and obstacles that make it harder for people to search, compare, and switch between products effectively.

These obstacles include complex and opaque pricing strategies, such as bonus interest rates, introductory offers and discretionary discounts. Pricing strategies that don’t just make it difficult for consumers to compare products but frequently don’t deliver the best value for their needs and budgets.

Additionally, a lack of consistency between bank websites and conflicted commercial arrangements with comparison websites make it even harder for consumers to obtain an objective view of the products on offer.

We also found that these issues persist, in part, due to a lack of competition in the retail banking market.

Concerns around insufficient competition in banking markets, and the Australian economy as a whole, are not unique to the ACCC.

You’ll likely be aware of the recent Australian Competition Tribunal decision, which set aside the ACCC’s decision not to authorise ANZ’s proposed acquisition of Suncorp’s banking arm. While the Tribunal reached a different view to the ACCC, it acknowledged the ACCC’s fundamental concerns in relation to aspects of competition in the banking sector.[3]

In this case, the Tribunal identified material barriers to entry and, in particular, expansion, remain in banking markets. One of these barriers that both the ACCC and the Tribunal observed is that historically there has been a relatively low propensity for customer switching.

In addition, the Better Competition, Better Prices - Economics Committee report released this year notes a lack of competition and dynamism across the Australian economy and in the financial services sector.[4]

Committee chair Dr Mulino noted, “Australia needs to lift its game when it comes to competition and economic dynamism because together they drive innovation, which in turns drives productivity. In the short term, this will put downward pressure on prices, thereby improving the cost of living”.

The Better Competition, Better Prices report recommends improving mortgage and deposit products from banks and improved regulation of the financial services market.

There are some promising changes on the horizon that relate to both competition and consumer protection issues.

In June this year, the government announced its support for a number of the recommendations in the ACCC’s inquiries including:

- Improving disclosure requirements for basic deposit products.

- Notifications to consumers when interest rates change on transaction or savings accounts, including when bonus rate and introductory offers end.

- Making it easier for customers to switch loans by ensuring they have direct and easy access to the forms needed to exit a mortgage; and

- Requiring financial product comparison websites to disclose what determines how products are ranked and the financial relationships they have with recommended product providers.

Importantly, the government has also asked that work be done on how behavioural economics and prompts could be used in the banking sector to encourage consumers to switch to cheaper home loans and retail banking products.

In addition, the Treasurer has also tasked the Council of Financial Regulators, in consultation with the ACCC, to undertake a review of the small and medium-sized banking sectors. This includes how small and medium banks compete in the market, as well as detailed consideration of the regulatory and market trends affecting them.[5]

Naturally, the ACCC is very pleased to be participating in this review, with a view to finding ways to appropriately balance competition, innovation, and stability.

Reducing card surcharges

As I speak on changes in the financial services sector to address cost of living pressures, this naturally brings me to another recent announcement on payment card surcharges for consumers and small businesses.[6]

This includes $2.1 million of new funding to the ACCC for the balance of this year and the next to tackle excessive card surcharging. The ACCC already has powers to take action against merchant surcharging that exceeds the merchant’s cost of card acceptance. While we welcome this announcement, we are also mindful of the balance to be achieved to deliver a better outcome for both consumers and small businesses.

The Reserve Bank of Australia’s first consultation paper released this month from its Review of merchant card payment costs and surcharging highlights just how complex this issue is within Australia’s payments system.[7]

We have worked with the RBA on card surcharges over many years and will continue to collaborate on solutions that support both consumers and businesses while ensuring fair competition in the payments system.

Strengthening consumer engagement with the Consumer Data Right

Another important area in which we see significant and exciting potential, is in the Consumer Data Right (CDR). The CDR is an important element of competition policy in a digital world.

In particular, the CDR is an enabling innovation for the Australian economy, with initial application to the banking sector and subsequently the energy sector.

There is growing interest in data sharing schemes – and particularly open banking – in countries around the world. According to the Bank of England[8], open banking is present in some form in over 80 countries, and just last week new rules for Personal Financial Data Rights were finalised to support open banking in the United States.

Many of you will be familiar that Australia’s CDR gives consumers the right to safely access data about them, held by data holders, and direct this information to be transferred to an authorised third party. Data transfers occur via secure technology and are subject to a rigorous consent process. With the CDR, there is no need for consumers to hand over their passwords or other login details, as is the case for data capture practices like screen-scraping.

The CDR is helping consumers to access new products and services, including better deals on a range of banking and financial products.

Importantly, the CDR doesn’t just give consumers greater control over their personal data but empowers their participation in the digital economy and promotes competition by lowering barriers to entry for new market participants.

The success and consumer benefits of the CDR are intrinsically linked to establishing a vibrant ecosystem of participants, and I’m pleased to say that the system is continuing to mature and develop.

As at 15 October 2024, there were 99 banking and energy data holders in the CDR, as well as 41 accredited data recipients. There were also a further 154, mostly fintechs, providing CDR services to consumers through representative arrangements.

Data sharing under the CDR is occurring on a daily basis. The underlying digital infrastructure of the CDR has handled increasingly heavy API traffic while maintaining fast response times. Data holders reported to the ACCC that they received almost 390 million requests for consumer data in the 6 months to June 2024.

We are also seeing continuing growth in the number of people who – having provided their consent to share data – are receiving CDR-related services from participants in the ecosystem.

In the six months to June 2024, CDR participants have reported to the ACCC that around 226,000 consumers across the Australian economy used the CDR. By mid-October, more than 300,000 ongoing data sharing arrangements were in place.

The CDR is poised for future growth and expansion of use cases. We are already seeing the system applied for diverse and innovative applications to mitigate cost of living pressures and to support the green transition.

Consumer use cases of CDR data in financial services include assessing financial positions to support mortgage applications; managing personal budgets; increasing savings through round-up investing apps; and comparing products to get the best value offers.

In the energy sector, applications of CDR data include analysing household energy use to reduce energy bills; and assessing the potential carbon savings of switching to alternative energy sources.

There is growing small business interest in use cases for CDR data, including for accounting, financial management and enterprise resource planning purposes.

Together with Treasury and other regulators, we are working to deliver new priorities for the CDR including its expansion to non-bank lending, improvements to consent arrangements and operational rules, and opportunities to reduce compliance costs.

We have also been actively collaborating with international jurisdictions and will continue to share our expertise and observations around best practice approaches to data sharing.

Enforcing competition law

As most of you know, the work of the ACCC in the financial services space extends to monitoring alleged breaches of competition laws, and taking court action, where necessary.

Right now, we are preparing for trial in our case against Mastercard which is set down for March 2025.[9] In this case, we allege that Mastercard offered discounts to more than 20 major retail businesses on the condition they committed to processing all or most of their Mastercard-eftpos debit card transactions through Mastercard rather than the eftpos network.

We allege that this had the purpose of substantially lessening competition in the supply of debit card acceptance services by deterring businesses from using the only alternative network, eftpos, even where it was the least cost.

Businesses across the banking and financial sector should be mindful that the ACCC will not hesitate to take action where necessary to protect competition including through court action.

Advocating for law reform: mergers

In addition to investigating allegations of anti-competitive conduct after it has occurred, the ACCC has, for a number of years, been strongly advocating for reforms to merger control in Australia to better identify and prevent anti-competitive transactions before they happen.

These reforms are particularly important in the context of the current environment where increasing market concentration and growing cost of living pressures are impacting the economy and consumers. We have now reached a significant milestone in the merger reform journey following the introduction of the merger reform bill to Parliament earlier this month.[10]

If passed by the Parliament, the new merger control regime represents a major change for the ACCC, business and the Australian community. Australia will move from a judicial enforcement model to a primarily administrative regime, with the ACCC as the first instance decision maker on each notified acquisition.

These changes are relevant not just for businesses when they are contemplating a merger, but for all businesses that may be affected by a merger such as suppliers, business customers in the supply chain and rivals.

The changes will benefit business stakeholders by ensuring they have clarity on their obligations, the timeframes they can expect, and other key aspects of the process. It will also provide greater transparency and opportunity to comment on transactions before the ACCC for the wider community, including consumers and small businesses.

If the legislation passes, the new regime will come into effect from 1 January 2026 with voluntary notification available from 1 July 2025 to assist businesses navigate the transition.

In anticipation of the new legislation coming into effect, the ACCC has issued Statement of Goals to outline its approach to implementing the new regime and to reduce uncertainty during the transition.[11]

These goals include greater transparency; a more efficient and faster process and more certain timelines for businesses seeking clearance, with new obligations on the ACCC to complete decisions within legislated timeframes. Under the new regime, we expect that approximately 80 per cent of mergers will be cleared within 15 to 20 business days.

In our Statement of Goals, we have also committed to a risk-based approach underpinned by enhanced data and economic analysis, with resources prioritised to acquisitions more likely to harm the community.

The ACCC is committed to making these reforms a success and there is significant implementation work underway to prepare for these changes.

Advocating for law reform: prohibiting unfair trading practices

In addition to merger law reform, we have also continued to advocate for the introduction of a prohibition on unfair trading practices. This reform is essential for protecting consumers and small businesses from conduct that currently falls outside the scope of the Australian Consumer Law despite causing considerable harm to consumers and small businesses.

In recent years, we have identified numerous examples of concerning business conduct which is unlikely to breach Australian Consumer Law but that causes real harm to consumers.

Many small businesses and consumers have limited bargaining power in their dealings with large businesses, making them more susceptible to unfair trading practices that exploit this imbalance in power.

Unfair trading practices create an uneven playing field for businesses and can discourage or inhibit small businesses from competing in markets. Businesses should be able to compete on the merits and the introduction of a prohibition of these practices would support this goal by removing the ability of businesses to use unfair tactics to gain an advantage.

It is worth noting that similar prohibitions exist in other jurisdictions. The European Union has implemented protections against unfair commercial practices, which have been successful in improving outcomes for consumers and promoting fair competition.

The ACCC considers that unfair trading practices reform would promote a new standard for business conduct, help to ensure that all businesses operate fairly and improve protections for all consumers.

We welcome the government’s recent announcement to consult on potential reforms to address currently unregulated unfair trading practices and we look forward to changes that will deliver meaningful benefits to consumers and small businesses.[12]

While the government is yet to consult on the potential for an unfair trading practices prohibition in the ASIC Act to cover financial products and services as well, the ACCC strongly supports a mirror reform being implemented in the ASIC Act.

The opportunities and challenges of the digital economy

Now to the second of the major forces driving fundamental change in financial services, the rise of the digital economy.

Digital technologies have enabled faster, more efficient transactions, and have created new opportunities for innovation. Consumers now have access to a wider range of financial products and services than ever before, and businesses have been able to expand into new markets thanks to the ease of digital payments and e-commerce.

However, with these opportunities come significant challenges. One of which is ensuring that the benefits of the digital economy are shared equitably, particularly among consumers and businesses that may be less digitally savvy or located in areas with limited access to digital infrastructure.

Disrupting and preventing scams

A significant challenge in the rise of the digital economy is the simultaneous rise of scams. At the ACCC we’re contributing to a more collaborative and cooperative approach to tackling scams through the National Anti-Scam Centre. This involves working closely with partners across government, law enforcement, industry including banks, telecommunications companies, digital platforms, consumer groups and the Australian Financial Crimes Exchange in combating scams.

Together we collect and share scam data and intelligence, implement scam prevention and disruption initiatives and provide better awareness alerts and education resources to help consumers identify and avoid scams.

Jayde Richmond, General Manager of the ACCC’s National Anti-Scam Centre is here today to discuss scam prevention in more detail so I will just briefly touch on a few key points from our work in this area.

We’ve seen some encouraging early signs that scam losses are trending down, and we’re grateful to everyone here who’s played a part in protecting Australians from being scammed. However, scams are still impacting far too many people.

The ACCC strongly supports the Government’s commitment to introduce mandatory and enforceable scam codes across the scams ecosystem under the new scams prevention framework legislation.[13]

We believe that the overarching principles of the scams prevention framework and these codes will promote consistent measures across sectors to address scams and provide clear roles and responsibilities for government, regulators, and the private sector including banks, telecommunications and digital platforms.

Beyond enforceable codes, the draft legislation is an economy-wide reform aimed at protecting Australians from scams. It takes a holistic approach, closing the gaps that scammers often exploit.

This framework imposes strong obligations to drive action against scams. It introduces tough penalties for non-compliance and establishes dispute resolution pathways for consumers to seek redress. Under the framework, the Minister for Financial Services can designate specific sectors, requiring them to have systems in place to prevent, detect, report, disrupt, and respond to scams and banks, together with telcos and digital platforms, will be among the first businesses to implement these changes.

Navigating declining cash use in the economy

As digital payments grow and cash usage declines, ensuring continued access to cash — especially in rural and remote areas — remains a priority.

Cash remains an important method of payment for many, especially the elderly, small businesses, and those in regions where digital infrastructure is not as robust.

However, the cash-in-transit industry is facing significant challenges due to the rise of digital transactions and resulting structural decline in the use of cash. This decline has raised concerns about the future viability of these services and the broader impact on access to cash, particularly for vulnerable groups. The ACCC was mindful of these concerns in the authorisation applications by the ABA and other parties and put conditions in place to mitigate these.

This includes recent authorisations to allow collaboration between key players in the financial and retail sectors to maintain access to cash-in-transit services.

Last year, the ACCC authorised Armaguard and Prosegur, the two major cash in transit providers in Australia, to merge, subject to a court-enforceable undertaking.[14]

This decision was not made lightly, as mergers of this kind can have far-reaching implications for competition. However, we took into account the unique challenges facing this industry, including the declining use of cash and the need to ensure that consumers continue to have access to cash services particularly in rural and remote areas, where access to cash is most critical.

Following the merger, concerns were raised about the sustainability of the cash-in-transit industry in its current form. In response, the Australian Banking Association (ABA) has lodged a number of applications with the ACCC seeking authorisation to allow its member banks, Australia Post, retailers, supermarkets, and other industry participants to collaborate.

This collaboration aims to develop industry-wide solutions to ensure the continued availability of cash services across the economy. It also aims to ensure business continuity measures if there were to be an event of failure of Armaguard; and develop longer-term measures to ensure the sustainability of cash-in-transit services.

The applications were lodged in the context of concerns raised by Armaguard, that the industry is not sustainable in its current form.

We recognised the urgency of this issue and have granted interim authorisations with reporting and transparency conditions, allowing the ACCC to monitor the progress of discussions and ensure that stakeholders, including rural and remote communities, are being adequately consulted.[15] , [16], [17], [18]

Our commitment to promoting healthy competition extends to areas of the financial services market where structural shifts are reshaping the landscape, including the evolving role of cash in the Australian economy.

The future of financial services: innovation and competition

As we look to the future, it is clear that the financial services sector is on the cusp of significant transformation. The rise of fintechs, the increasing use of artificial intelligence, and the continued growth of digital payments are all driving innovation in the sector.

These innovations may lead to new competition, new markets, innovation, and business opportunities. They also have the potential to deliver significant benefits to consumers by increasing efficiency, reducing costs, and providing access to a broader range of financial products.

However, we must also continue to actively monitor innovations and developments to ensure that we continue to protect consumers and promote fair competition in this evolving landscape.

A recent example is the proposal from Apple to voluntarily open access to its near field communication technology for Australian developers.[19]

While the ACCC supports Apple’s moves to voluntarily provide greater access to hardware functionality such as NFC, we understand Apple has not publicly announced the full details of this change, including the payments that will be required by those seeking access.

Amendments to the payment systems regulatory framework that would enable regulation of digital wallet services – among other things - are currently before Parliament.[20]

The ACCC continues to work closely with Treasury to progress Government consideration of our recommended consumer protection and competition regulatory reforms for digital platforms.

These include new mandatory competition codes of conduct which would apply to the largest and most powerful digital platforms according to designation criteria reflecting their importance to Australian consumers, businesses and markets, and their ability and incentive to harm competition.

Timely reform in Australia would ensure that Australian consumers and businesses are able to benefit from changes like those already being made overseas with similar reforms in jurisdictions including the United Kingdom, Germany, Japan, and the European Union.

Protecting consumers in the face of climate change

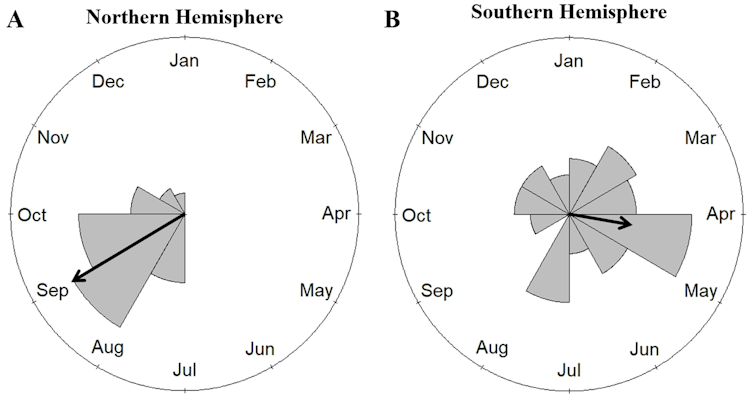

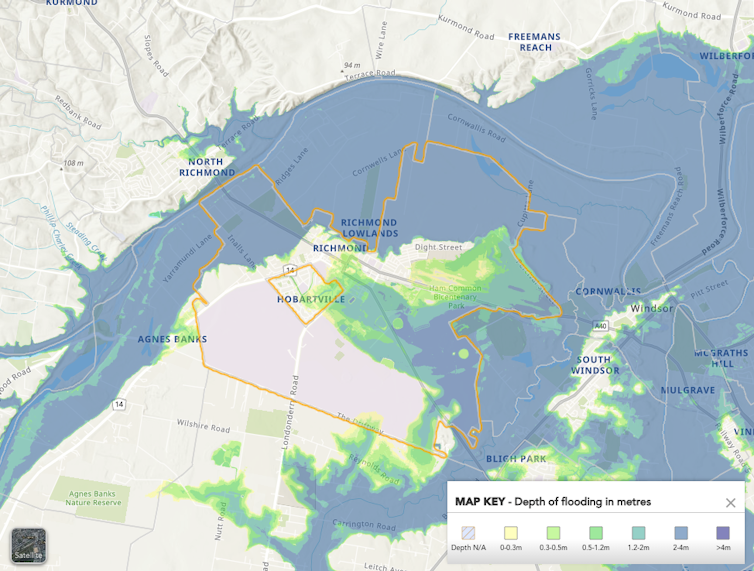

Now to the final force driving financial sector transformation that I will mention today, climate change. As we all know, the impacts of climate change are no longer a distant threat. We’re seeing more frequent and more severe weather events, and for many Australians, especially in cyclone-prone and flood-prone regions, this means higher risks to their homes and livelihoods.

The Australian Government’s cyclone reinsurance pool was created to help reduce insurance premiums for those living in areas of greater risk. We are now seeing some positive outcomes of this government intervention, with the ACCC’s latest monitoring report on the cyclone reinsurance pool revealing that the pool has begun delivering lower premiums for some consumers in some regions.[21]

We have seen that the pool has led to some savings for insurers writing policies in higher cyclone risk regions of Australia. We’ve also seen insurers making changes to pass these savings on to consumers.

These savings, however, have been offset to varying extents by a range of cost pressures. Global reinsurance markets are hardening, extreme weather events are becoming more frequent, and the costs of building materials and labour are on the rise. These pressures are making it harder for consumers to see the full benefits of the pool in passed on savings.

The reality is insurance premiums remain very high for many Australians. This is a consequence of living in a changing climate and we continue to hear consumers say that the cost of insurance for their home or small business has become so prohibitive they’re forced make difficult choices — either risk underinsurance or go without insurance altogether.

We are optimistic that the pool can deliver some relief for those most at risk from cyclones, but the pool alone won’t solve the broader issue of insurance affordability more generally.

As climate change accelerates, it is reshaping not just our weather patterns but our entire approach to risk management. We continue to believe that there remains significant merit in many of the recommendations we made in our Northern Australia Insurance Inquiry to improve the way insurance markets are working for consumers in a world where extreme weather events are becoming more frequent and severe.[22]

Other reports from government and industry have also reinforced the need for action. We continue to work closely with government, industry, and regulators to help ensure that communities facing the impact of climate change are not left behind, and that insurance remains accessible and affordable, even in the face of mounting climate risks.

Navigating change into the future

In conclusion, the financial services sector is undergoing significant transformation, driven by a range of factors including cost of living pressures, the rise of the digital economy, and climate change. The ACCC is committed to navigating these changes in a way that promotes competition, protects consumers, and ensures that the benefits of innovation are shared widely.

We look forward to continuing our work in this space and to engaging with industry, government, and other stakeholders to shape the future of financial services in Australia and navigate the opportunities and challenges that lie ahead, together.

Thank you.

Footnotes

[1] Australian Competition and Consumer Commission, ‘Retail deposits inquiry 2023’ (Report, 15 December 2023).

[2] Australian Competition and Consumer Commission, ‘Home loan pricing inquiry 2020’ (Report, 5 December 2020).

[3] Australian Competition and Consumer Commission, ‘ACCC update on Tribunal’s decision to authorise ANZ's acquisition of Suncorp’ (Media release, 5 March 2024)

[4] Dr Daniel Mulino MP, ‘Better Competition, Better Prices - Economics Committee report’ (Report, 27 March 2024).

[5] The Hon Jim Chalmers MP Treasurer, ‘Helping Australians get a better deal on banking products’ (Media release, 15 June 2024).

[6] Prime Minister of Australia, The Hon Anthony Albanese MP, ‘Reducing card surcharges for Australians and small businesses’ (Media release, 15 October 2024).

[7] Reserve Bank of Australia, ‘Merchant cards payment costs and surcharging’ (Issues paper, October 2024).

[8] Bank of England, ‘Customer data access and fintech entry: early evidence from open banking’ (Staff Working Paper 1059, February 2024).

[9] Australian Competition and Consumer Commission, ‘Mastercard in court for alleged misuse of market power over card payments’ (Media release, 3 May 2022).

[10] Parliament of Australia, ‘Treasury Laws Amendment (Mergers and Acquisitions Reform) Bill 2024’ (Bill, 10 October 2024).

[11] Australian Competition and Consumer Commission, ‘Statement of Goals for Merger Reform Implementation” (Publication, 10 October 2024).

[12] Prime Minister of Australia, The Hon Anthony Albanese MP, ‘Albanese Government to stop the rip offs from unfair trading practices’ (Media release, 16 October 2024).

[13] Treasury, ‘Scams Prevention Framework – exposure draft legislation’ (Draft legislation, 4 October 2024).

[14] Australian Competition and Consumer Commission, ‘Linfox Armaguard Pty Ltd and Prosegur Australia Holdings Pty Ltd proposed merger’ (Determination, 13 June 2023).

[15] Australian Competition and Consumer Commission, ‘ Australian Banking Association (CIT Initiatives and Business Continuity Planning)’ (Application, 18 October 2024).

[16] Australian Competition and Consumer Commission, ‘Australian Banking Association Limited determination’ (Determination, 12 September 2024).

[17] Australian Competition and Consumer Commission, ‘Australian Banking Association Limited – CIT Sustainability Measures’ (Application, 27 June 2024).

[18] Australian Competition and Consumer Commission, ‘Australian Banking Association Ltd (cash-in-transit initiatives)’ (Application, 27 May 2024).

[19] Apple, ‘Developers can soon offer in‑app NFC transactions using the Secure Element’ (Media release, 14 August 2024).

[20] Parliament of Australia, ‘Treasury Laws Amendment (Better Targeted Superannuation Concessions and Other Measures) Bill 2023’ (Bill, 16 May 2024).

[21] Australian Competition and Consumer Commission, ‘ACCC Insurance monitoring report 2024’ (Report, 19 September 2024).

[22] Australian Competition and Consumer Commission, ‘Northern Australia insurance inquiry 2017-20’ (Report, 28 September 2020).

![]()

.jpg?timestamp=1721759749783)

Central Coast beverage company, Eastcoast Beverages, unveiled three new limited edition label designs on October 21 2024, designed by TAFE NSW Newcastle students. A launch event was held at their facility to celebrate the students’ success in designing labels for the company, one of Australia’s largest family-owned juice brands.

Central Coast beverage company, Eastcoast Beverages, unveiled three new limited edition label designs on October 21 2024, designed by TAFE NSW Newcastle students. A launch event was held at their facility to celebrate the students’ success in designing labels for the company, one of Australia’s largest family-owned juice brands.